We understand that preserving and growing wealth requires careful planning and expert guidance. We believe in a holistic approach to investment advisory, combining in-depth market research, rigorous analysis, and a deep understanding of our clients' financial objectives. Our team works closely with each client to develop a customized investment strategy that aligns with their risk tolerance, time horizon, and financial aspirations.

Our investment advisory services are driven by a client-centric approach, where trust, integrity, and personalized attention form the foundation of our relationship with every client.

Let us help you navigate the complex world of investments and make informed decisions to secure your financial future.

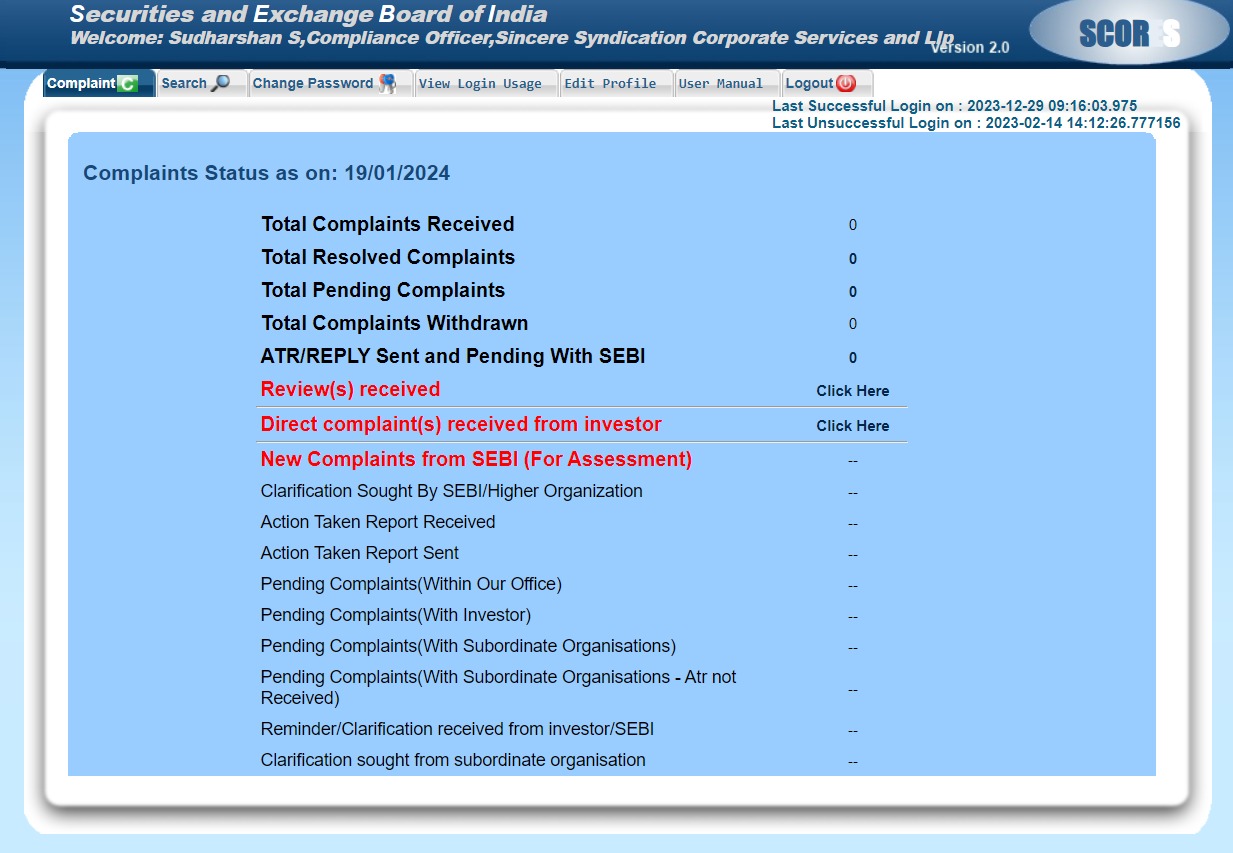

In case of any complain or queries: Please contact our compliance officer Mr. Sudharshan, at email id – compliance@sinceresyndication.com and phone no +91- 93459 60400.

A management & strategy professional with proven excellence in the functional areas of business management, finance and investment banking.

Siva has worked with large companies & start-ups in India, Indonesia & Singapore with business exposure to the geographies of India, SE Asia, Europe and the US. He has led teams of professionals from various geographies to achieve organizational goals.

He held responsible positions in the sectors of Energy, Banking, Private Equity, Digital media, FMCG, Retail distribution, Manufacturing, Engineering and Plantations.

Siva has been at the forefront of raising over Rs. 5500 crores ($800 million) of funds in the form of debt & equity & through mezzanine structures in India, Singapore and Indonesia. Besides, he has been part of M&A transactions worth over Rs. 4200 crores.

Siva’s innovative out-of-box business solutions & constant endeavor to create value for the client have been a key strength of Sincere Syndication.

Siva is a qualified Chartered Accountant from The Institute of Chartered Accountants of India.

Lakshmanan has over 30 years of experience in General Management, Industrial finance & General Insurance. He has held responsible roles in large corporate such as Shriram Group, Essar Group, Murugappa Group & Bajaj Allianz. He held several Board positions in Shriram Group of Companies.

Lakshman has syndicated funds from Financial Institutions & Banks for industrial projects in the field of plastics, bulk drugs ,Pharmaceuticals, engineering and automobile ancillaries. He has to his credit of successfully managing 2 IPOs. He has raised funds from VC investors and Angel Investors for early-stage opportunities.

Being a reputed insurance expert, Lakshmanan has handled large fire, flood and marine claims for large corporates like Sterlite group, KCP, Chemfab Alkalies, Ucal Group, Orchid chemicals etc and has successfully handled arbitration cases in relation to insurance claims & settlements.

At Sincere Syndication, Lakshman brings with him wide experience in diverse fields of knowledge & an excellent business network across industries.

Lakshmanan is a Master of Technology from I I T Madras.

A senior legal counsel with 42 years of experience in spanning across varied legal matters. He has achieved significant success in complex legal issues in several areas including - Arbitration issues, Company law matters, Real estate, Commercial laws, Succession cases, Family Matters & Partition of Estates.

Still an active legal practitioner in the High Court of Madras and all the subordinate courts in Tamil Nadu since 1974. He has handled certain landmark legal issues and successfully resolved them. He provides legal consultancy services

Raghavan has worked with legal luminaries such as

Today, Raghavan guides several lawyers in South India in legal consultancy services.

With such a very wide array of experience in diverse legal matters, Raghavan is a boon to clients of Sincere Syndication in providing expert legal consultancy services.

Starting his career as a Project Engineer in NEG Micon, Pramodh has come a long way to become the Strategic Partner of ‘Sincere Syndication and Corporate Services LLP’ in the energy consultancy front.

He has also worked as an Energy consultant for various Multinationals in the Industry and brings with him a wide range of experience and skill on that front.

Pramodh is an Electrical and Electronics Engineer from the University of Madras anda Masters in ‘Renewable Energy’ from the renowned Curtin University in Australia.

His expertise in Renewable Energy and natural resources consultancy provides immense technical strength to ‘Sincere Syndication’.