Join us in navigating the dynamic currents of the market and uncovering the untold stories that shape the future.

We look forward to welcoming you to our esteemed investor community.

Our investment objective is to create a diversified equity portfolio that endeavors to achieve long term value creation and thereby multiplying the capital multifold.

The Metamorphosis fund follows sector agnostic and multi-cap approach with specific focus to uncover and invest in the transformative journey of companies transitioning from today's micro caps, small caps, and mid-caps to becoming the mid-caps and large caps of tomorrow.

The fund employs a blend of top-down and bottom-up approach for stock selection to capture opportunities at intersection of Growth and Value.

Exploring the vast landscape of under-researched and under-owned opportunities, we go beyond the obvious, discovering compelling ideas that align with India's growth narrative and its myriad compounding stories.

Our aim is to play on top line growth and margin expansion coupled with improvement in ROE and ROIC. The fund goes beyond traditional financial analysis, seeking companies with effective leadership, scalable operations, pricing power, enduring competitive advantages, and recognizable brands.

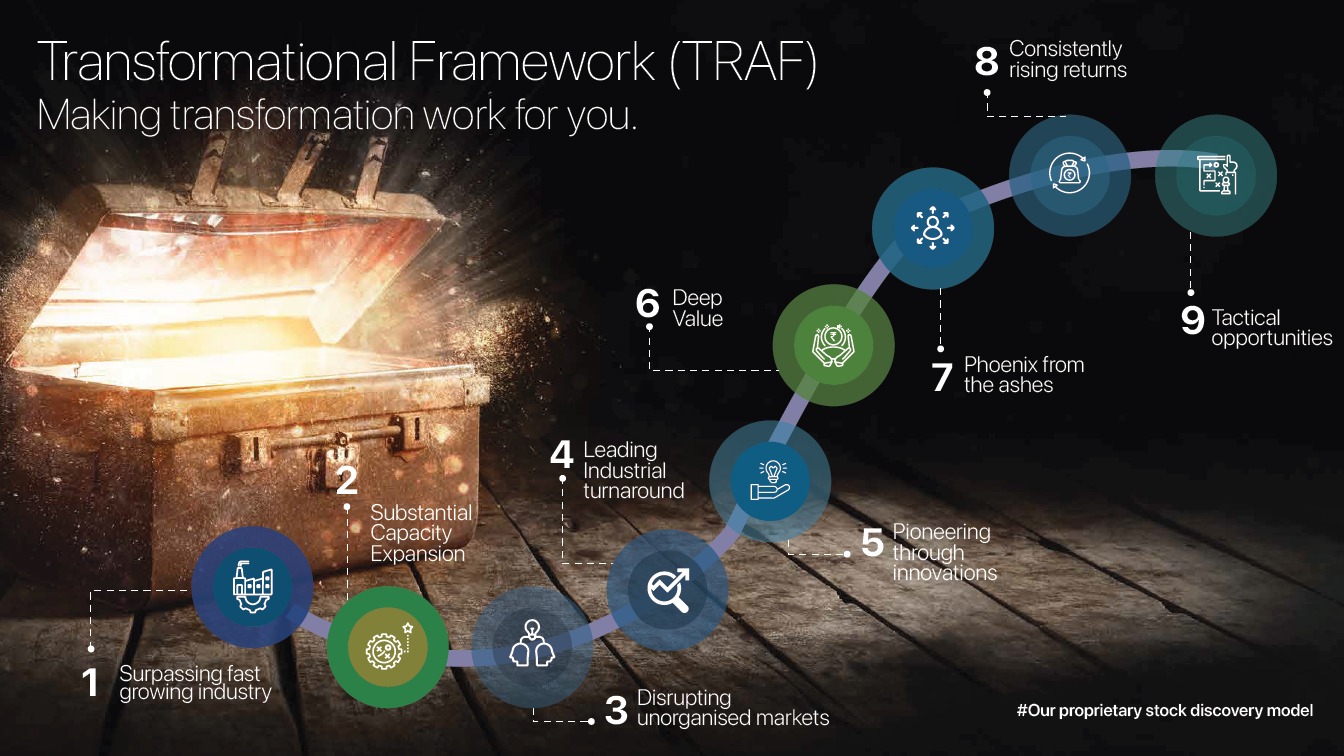

At the heart of our success lies the "Transformational Framework" engine, meticulously evolved over time to identify potential multi-baggers. Our strategy is rooted in recognizing transformations fueled by innovation-driven moats, significant scale achievements, and turnarounds supported by industry tailwinds. The companies in our portfolio are poised to see their profits double in less than 3 years.

For further details about our fund, please refer to our dedicated team of experts.

Please reach out to us at connect@sinceresyndication.com or  to schedule a meeting or a call.

to schedule a meeting or a call.

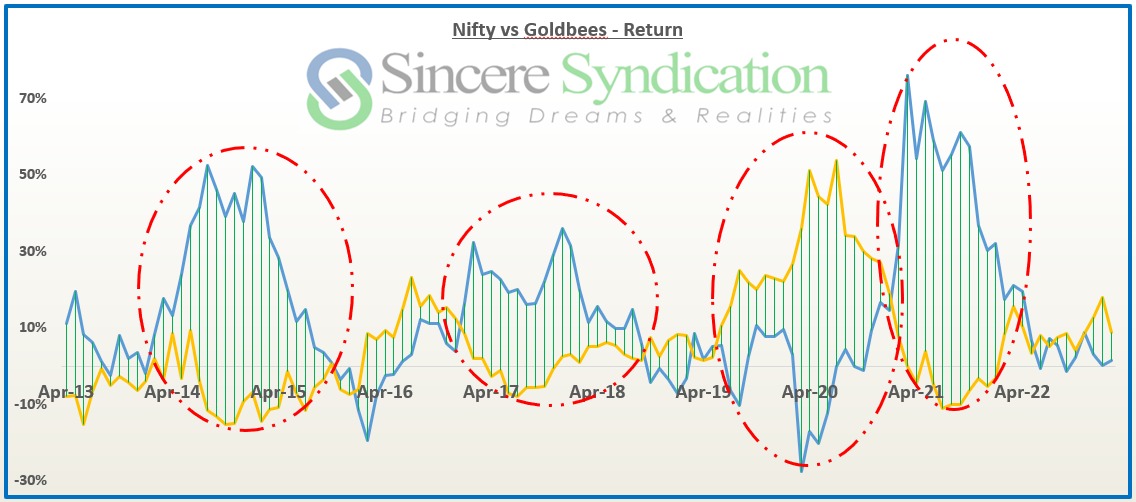

Different asset classes have varying return profiles and trajectory. There is an inverse correlation between the prices of multiple asset classes.

For instance, gold and stocks have a negative correlation. Historically, when equities fetched returns of over 2X of India10-year bond yields, 83% of the time, return on Gold ETFs in India was lesser than India10-year bond yields. While at the same time, on most of the occasions when gold performed well, equities have fetched lesser returns. On a similar note, when the interest rates tend to be higher, the equity returns tend to be lower and vice versa.

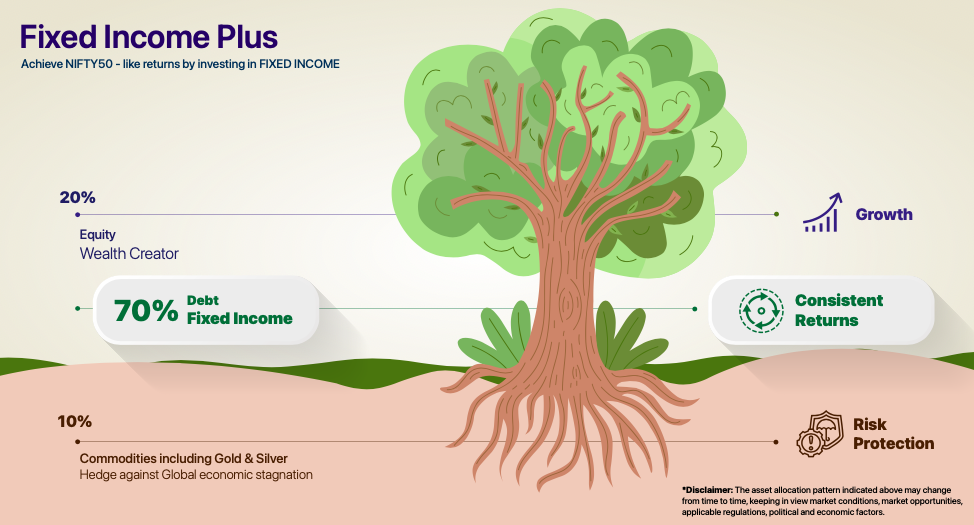

The portfolio shall consist of an appropriate combination of debt instruments, along with equities & commodities to achieve the following objectives: Debt instruments shall be largely in the form of bonds & debentures, which would fetch fixed income, irrespective of the market conditions.

A portfolio of equity-oriented instruments in the form of stocks & ETFs would be added to the portfolio to provide an incremental delta to return on investments.

Gold / Silver related instruments & Exchange Traded Commodity Derivatives in the portfolio will function as a hedge against underperformance of the stock market.

REITs, INVITs & such other instruments may also be added to the portfolio from the perspective of fixed income & capital appreciation.

The objective of having bonds & debentures in the portfolio would be to hold them till maturity. However, we shall take advantage of the interest rate cycles to generate incremental returns on bonds, over & above their yield till maturity.

Such an approach of investing will fetch inflation-beating returns with lesser volatility. Further, the investment approach is likely to achieve returns that are ahead of any fixed income instrument and closer to returns from equities.

The investment strategy is called fixed income plus as it seeks to achieve high returns than fixed income investment by leveraging on tactical exposure towards equity and other asset classes.

Please reach out to us at connect@sinceresyndication.com or  to schedule a meeting or a call.

to schedule a meeting or a call.

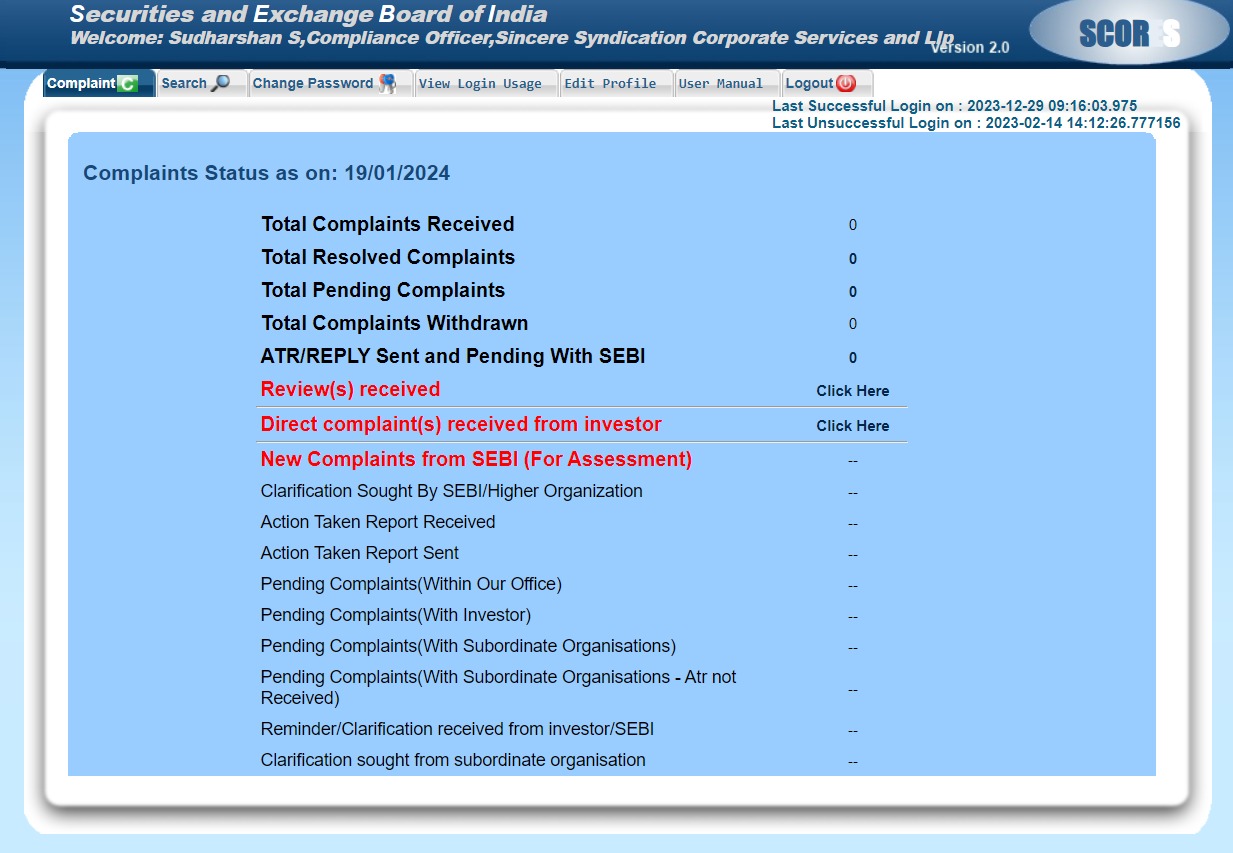

In case of queries or complaints, you may reach out to us by email at connect@sinceresydication.com or by WhatsApp at 9345960400.

Sincere Syndication is a Registered Investment Adviser with SEBI – RIA Registration number: INA000017453

Sincere Syndication provides portfolio Management Services – PMS Registration number: P M / INP200007803

A management & strategy professional with proven excellence in the functional areas of business management, finance and investment banking.

Siva has worked with large companies & start-ups in India, Indonesia & Singapore with business exposure to the geographies of India, SE Asia, Europe and the US. He has led teams of professionals from various geographies to achieve organizational goals.

He held responsible positions in the sectors of Energy, Banking, Private Equity, Digital media, FMCG, Retail distribution, Manufacturing, Engineering and Plantations.

Siva has been at the forefront of raising over Rs. 5500 crores ($800 million) of funds in the form of debt & equity & through mezzanine structures in India, Singapore and Indonesia. Besides, he has been part of M&A transactions worth over Rs. 4200 crores.

Siva’s innovative out-of-box business solutions & constant endeavor to create value for the client have been a key strength of Sincere Syndication.

Siva is a qualified Chartered Accountant from The Institute of Chartered Accountants of India.

Lakshmanan has over 30 years of experience in General Management, Industrial finance & General Insurance. He has held responsible roles in large corporate such as Shriram Group, Essar Group, Murugappa Group & Bajaj Allianz. He held several Board positions in Shriram Group of Companies.

Lakshman has syndicated funds from Financial Institutions & Banks for industrial projects in the field of plastics, bulk drugs ,Pharmaceuticals, engineering and automobile ancillaries. He has to his credit of successfully managing 2 IPOs. He has raised funds from VC investors and Angel Investors for early-stage opportunities.

Being a reputed insurance expert, Lakshmanan has handled large fire, flood and marine claims for large corporates like Sterlite group, KCP, Chemfab Alkalies, Ucal Group, Orchid chemicals etc and has successfully handled arbitration cases in relation to insurance claims & settlements.

At Sincere Syndication, Lakshman brings with him wide experience in diverse fields of knowledge & an excellent business network across industries.

Lakshmanan is a Master of Technology from I I T Madras.

A senior legal counsel with 42 years of experience in spanning across varied legal matters. He has achieved significant success in complex legal issues in several areas including - Arbitration issues, Company law matters, Real estate, Commercial laws, Succession cases, Family Matters & Partition of Estates.

Still an active legal practitioner in the High Court of Madras and all the subordinate courts in Tamil Nadu since 1974. He has handled certain landmark legal issues and successfully resolved them. He provides legal consultancy services

Raghavan has worked with legal luminaries such as

Today, Raghavan guides several lawyers in South India in legal consultancy services.

With such a very wide array of experience in diverse legal matters, Raghavan is a boon to clients of Sincere Syndication in providing expert legal consultancy services.

Starting his career as a Project Engineer in NEG Micon, Pramodh has come a long way to become the Strategic Partner of ‘Sincere Syndication and Corporate Services LLP’ in the energy consultancy front.

He has also worked as an Energy consultant for various Multinationals in the Industry and brings with him a wide range of experience and skill on that front.

Pramodh is an Electrical and Electronics Engineer from the University of Madras anda Masters in ‘Renewable Energy’ from the renowned Curtin University in Australia.

His expertise in Renewable Energy and natural resources consultancy provides immense technical strength to ‘Sincere Syndication’.